Grido

Summary

Grido automatically buys low and sells high by placing orders with price trailing to the current open highest bid (or lowest ask).

Grido checks for the current highest bid of the market and places a set of bid orders within a calculated price range. As the market price changes, Grido will place an ask order for every hit bid order as a higher price. If no order got hit, the full open bid ladders will move together with the new market price.

Grido performs best in sideway markets.

About Grido

The traditional Grid trading strategy is the practice of placing a set of bid orders below a reference price and a set of ask orders above said price, creating a grid of orders. As the market price goes up and down, these orders will be hit accordingly.

Grid + Alvisio = Grido

Grido is the perfect combination of the traditional Grid strategy and Alvisio’s dynamic features of smart calculation, conditional deployment, and multiple defense mechanisms.

With Grido, you don’t need to set up a fixed predetermined reference price range. Instead, Grido will automatically calculate the optimal price range using the current highest open bid and/or lowest open ask order and place the bid-ask ladder accordingly.

For every hit bid order, Grido will place an ask order at a higher price and vice versa. If no order got hit, Grido will move the full open ladder together with the new market price. This together with the defense mechanism is where Grido is more powerful and dynamic than traditional grid trading.

| Traditional grid trading | Alvisio’s Grido |

|---|---|

|

|

Bot Settings & Defense Mechanisms

All of Alvisio's bots come with a set of predefined parameters (default settings) that can be launched with just a click of a button. Traders are welcome to adjust these settings to better suit their trading style and market conditions.

General settings

General settings like choosing exchange & market, setting up trading amount,… are applied to all of Alvisio’s bots. Please find more details here.

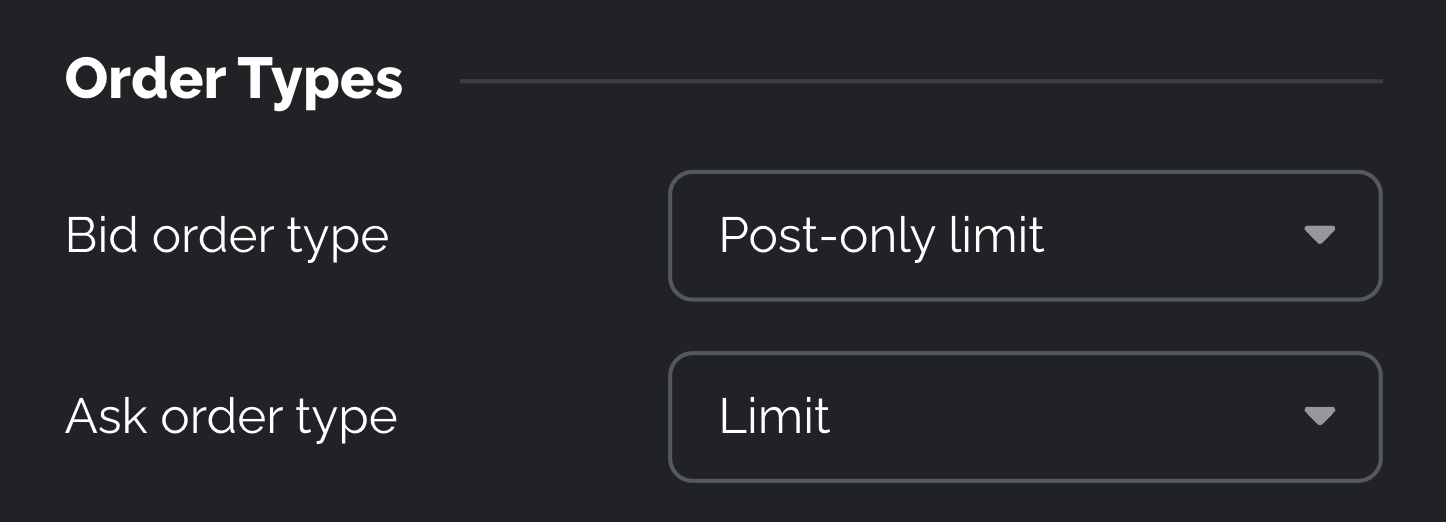

Order types

- Bid/Ask order type: You can choose between

Post-only limitorLimit:- A

limitorder is an order to execute a transaction only at a specified price (the limit) or better. - A

post-only limitorder is either placed in the order book or expires if matches an existing order. Post-only option guarantees that you will not pay the taker fee.

- A

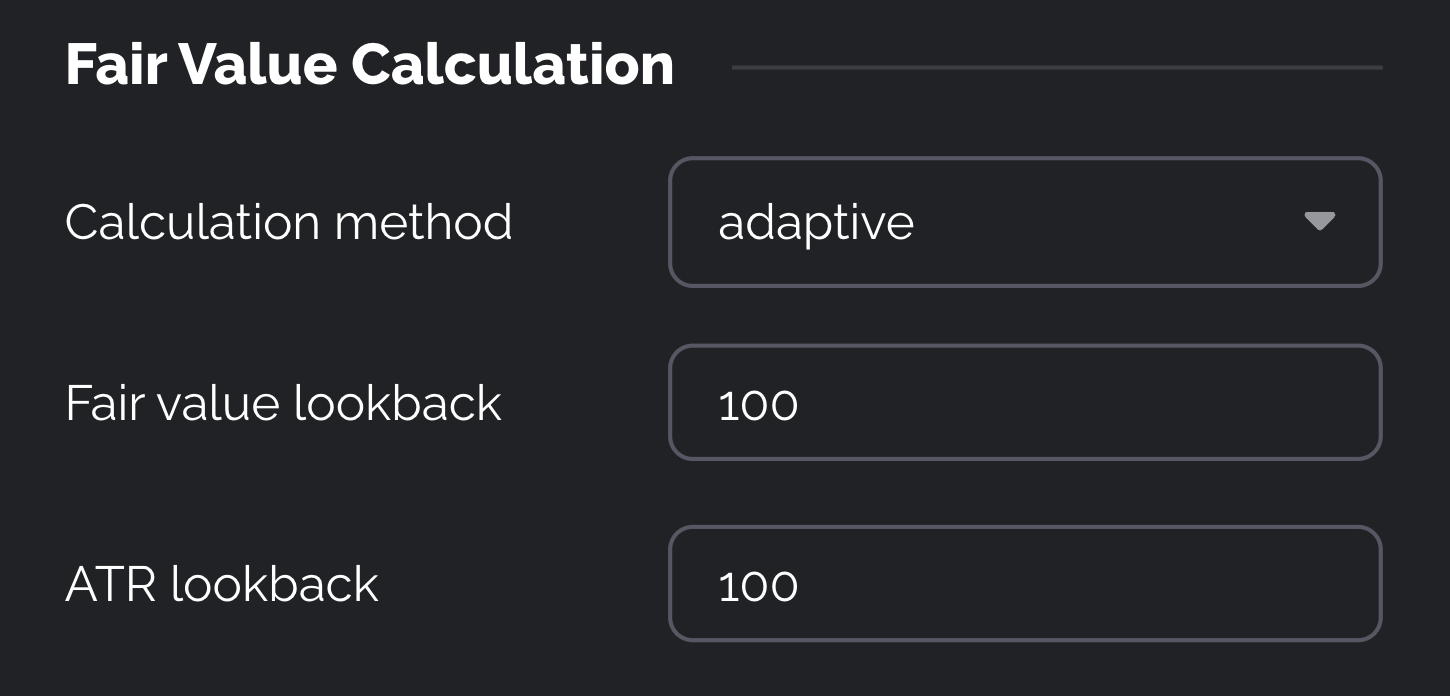

Fair Value Calculation

- Calculation method: method to calculate the dynamic center (aka the fair value of the chart)

adaptiveis KAMA of the close prices using default parametersprice structureis the Donchian Channel's centerEMAis the exponential moving average

- Fair value/ATR lookback: the number of past candles being used to calculate Fair value/ATR.

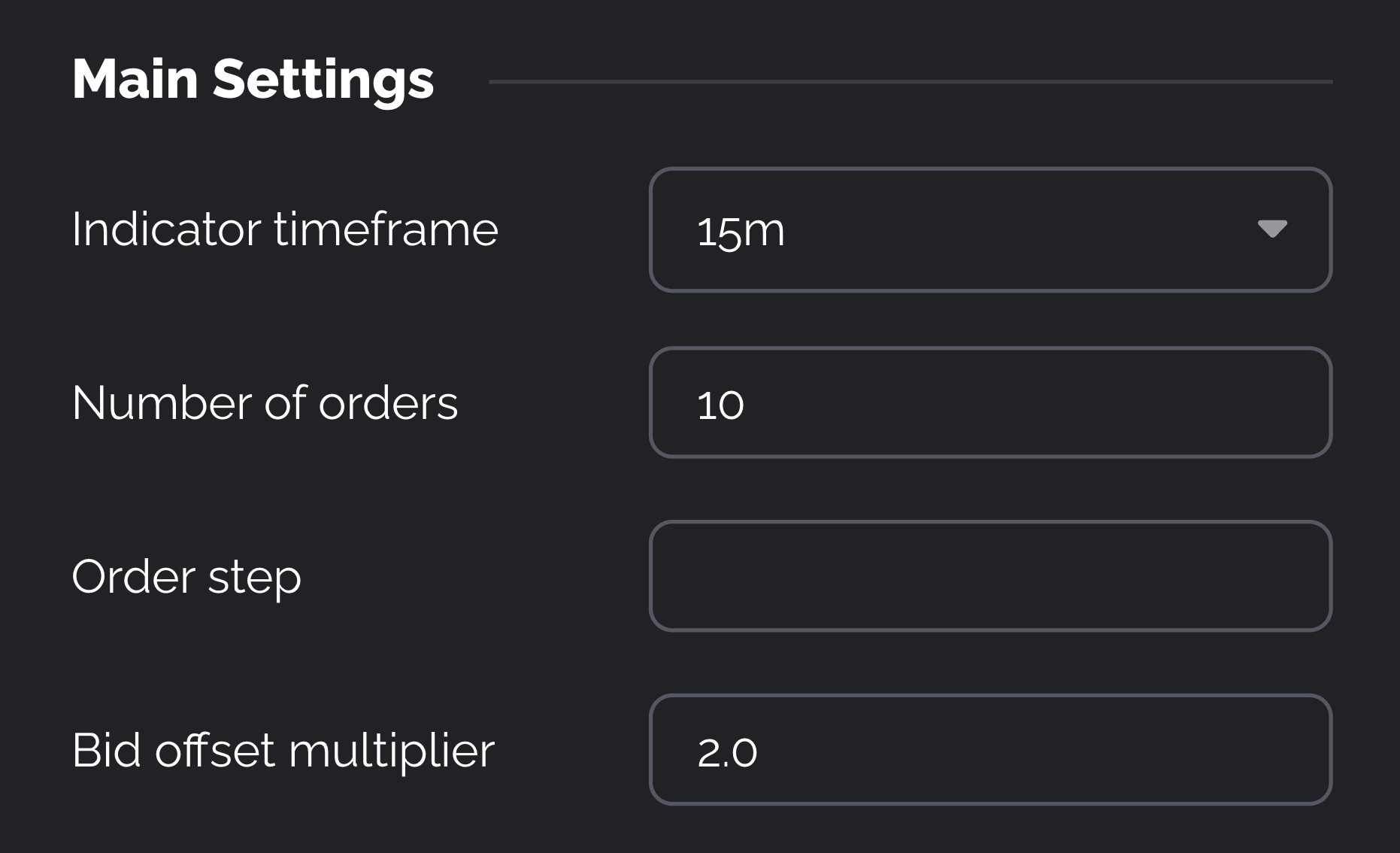

Main settings

- Number of orders: the maximum open orders

- Order step: the gap between 2 orders

- Bid offset multiplier: The distance (how many steps) between the highest bid and the highest open bid

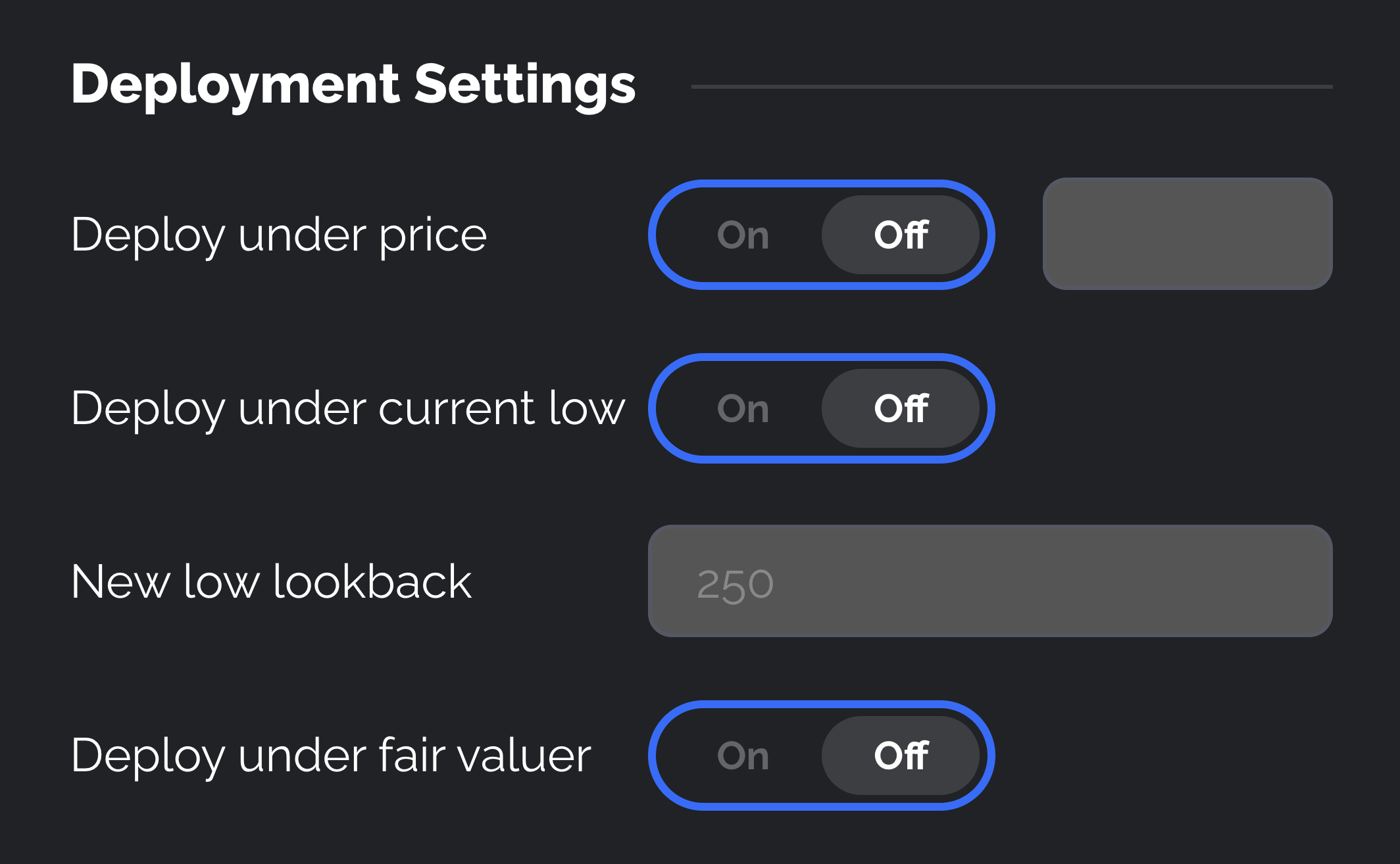

Deployment settings

Deployment settings serve as an extra layer of conditions for bidding on an asset.

- Deploy under price: Only place orders under this price

- Deploy under new low: Only place order under the new low price point

- New low’s lookback: number of past candles to calculate the low value

- Deploy under fair value: Only place orders under the fair price

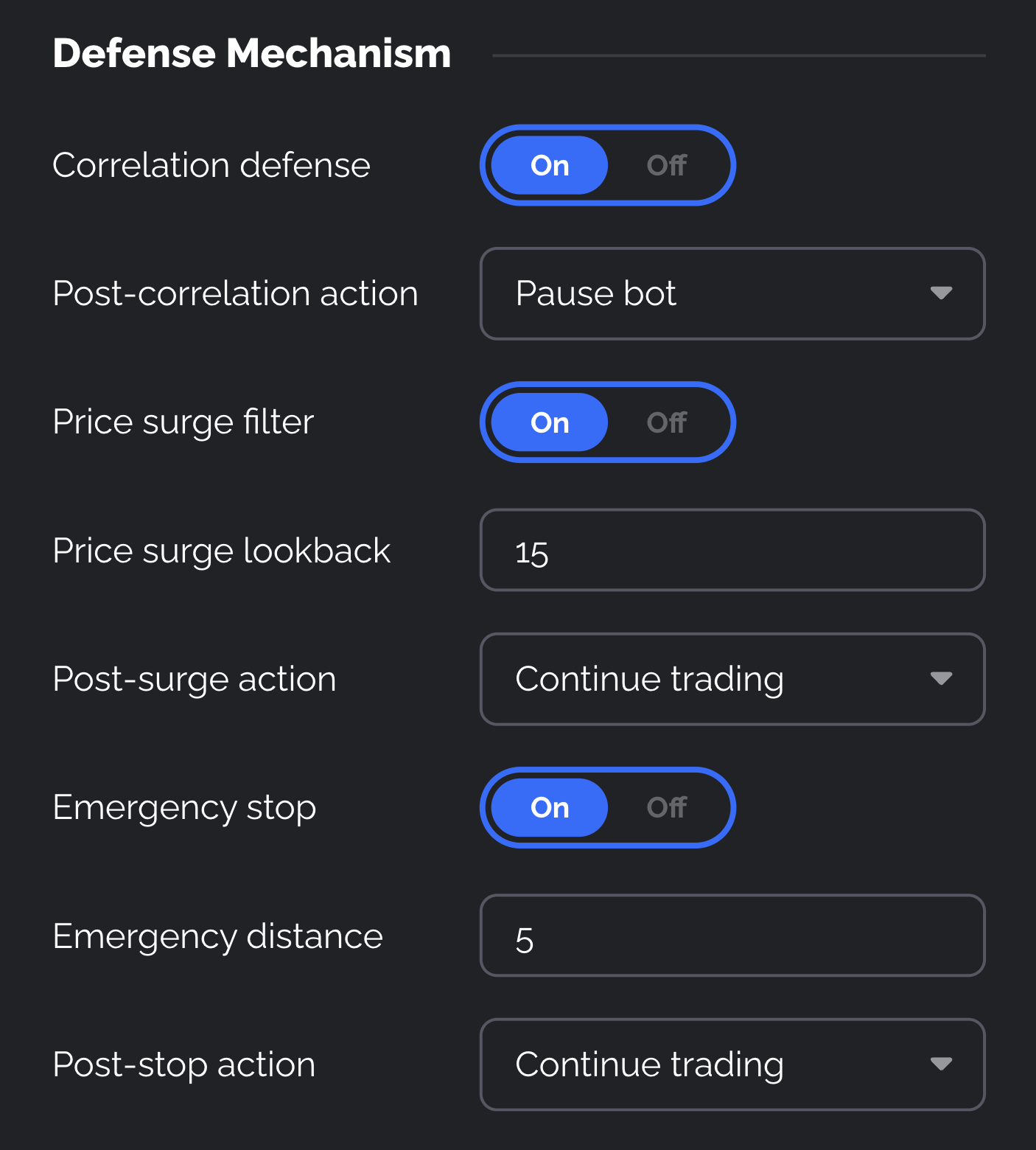

Defense mechanisms

Grido is equipped with 3 different defense mechanisms to best co-op in the volatility and uncertainty of the market. You can read more about them in Defense Mechanisms.

- Post-defense action: You can choose between

Pause botandContinue tradingPause bot: pause the bot immediately right after placing an ask order to get out of trade.Continue trading: put the bot instand-bymode and closely monitor the market to automatically resume trading when the trend is back to normal.

- Price surge lookback: number of past candles to calculate the surge-trigger value.

- Emergency distance: any value from 1 to 20, with a recommended setting of 5. The higher the distance setting, the higher the risk tolerance!

- If the distance is set to 1, the Emergency Stop will be triggered as soon as the price drops by 1 step from the current lowest open bid, resulting in a more conservative approach.

- Conversely, if the distance is set to 10, the Emergency Stop will only be triggered if the price drop by 10 times the current step, resulting in a much more aggressive approach.