Momento

Summary

Designed to capitalize on market trends, Momento utilizes advanced technical indicators and real-time data analysis to automatically identify strong buy and sell points and timely execute orders to secure profits.

Think of Momento as a "buy high, sell higher" strategy, equipped with real-time signal detection and instant order execution capabilities.

About Momento

Momento adheres to the underlying principle of market momentum, which suggests that assets that have performed well in the past are very likely to continue performing well in the future, while assets that have performed poorly are highly probable to continue underperforming.

Momentum + Alvisio = Momento

Momento is the perfect combination of the momentum trading strategy and Alvisio’s dynamic features of smart calculation and conditional deployment.

Momento's strength is its ability to monitor the market continuously in real-time, allowing it to promptly detect signals and take immediate action. This ensures that Momento can capitalize on swiftly changing market trends by executing orders without delay, thereby maximizing profit potential.

Alvisio's Momento has four built-in technical indicators: SuperTrend, Hull MA, KAMA (Kaufman's Adaptive Moving Average), and EMA (Exponential Moving Average). Users have the flexibility to select any combination of these indicators, including all four, and customize parameters such as length and tolerance threshold to tailor their strategy for determining entry and exit points.

Bot Settings

All of Alvisio's bots come with a set of predefined parameters (default settings) that can be launched with just a click of a button. Traders are welcome to adjust these settings to better suit their trading style.

General settings

General settings like choosing exchange & market, setting up trading amount,… are applied to all of Alvisio’s bots. Please find more details here.

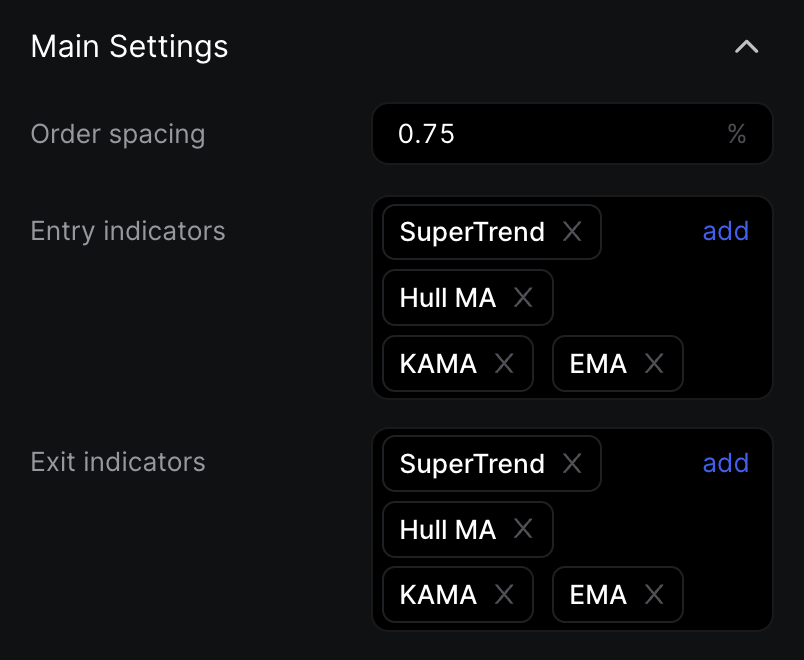

Main settings

- Order Spacing: The minimum percentage of space between the two orders.

- Indicators: Select any indicator(s) for entry and exit point calculation. Indicators for entry and exit can be different.

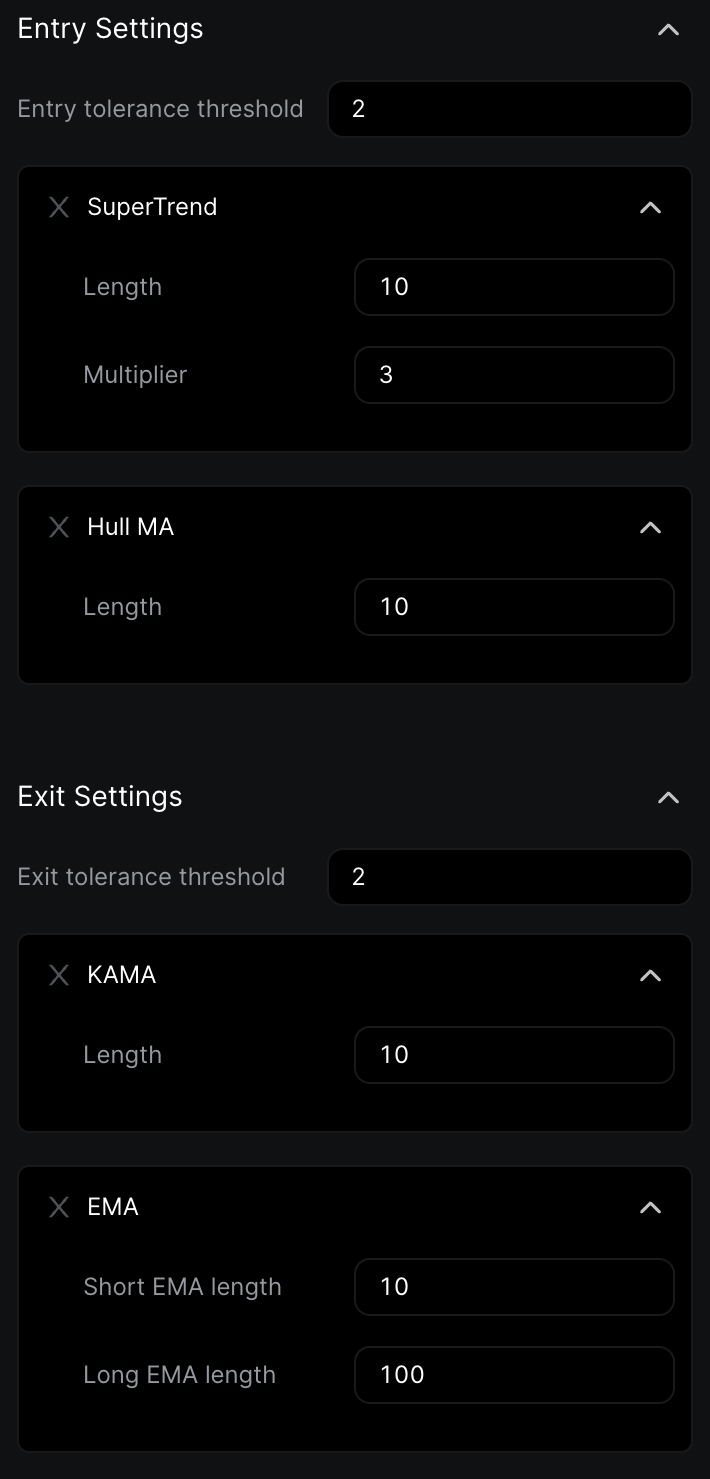

Entry/Exit settings

-

Tolerance Threshold: The tolerance threshold helps control risk and ensures trades stay within acceptable range by placing limits on how far the price can deviate from the previously closed price when entering or exiting a trade.

- Example:

Entry tolerance threshold= 2Entry price= 102% *the previously closed price

- Example:

-

SuperTrend: SuperTrend is a a widely-used technical analysis tool to help identify trends, manage risk, and confirm market tendencies. It is computed by adjusting the market's closing price with a measure of market volatility (ATR) multiplied by a specified multiplier.

-

Hull MA: Hull Moving Average is designed to reduce lag in moving averages by using a weighted calculation that gives more emphasis to recent price action while still consider historical prices. It is more responsive to current market conditions and adapts more quickly to changes in price trends.

-

KAMA: Kaufman Adaptive Moving Average dynamically adjust its sensitivity to price changes based on market conditions.

-

EMA: Exponential Moving Average is a type of moving average that prioritizes recent price data, providing a smoother and quicker response to changes in price trends compared to other moving average types.

-

Length: the number of historical candles being used to calculate indicator. Momento only uses 1-min candle.